Physical Power Purchase Agreements (Physical PPAs)

What is a Power Purchase Agreement?

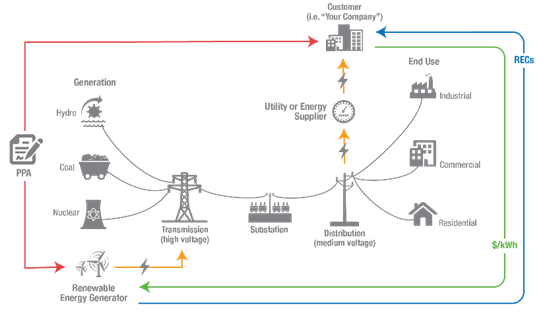

A Physical Power Purchase Agreement (Physical PPA) for renewable electricity is a contract for the purchase of power and associated RECs from a specific renewable energy generator (the seller) to a purchaser of renewable electricity (the buyer). Physical PPAs, which are usually 10 -20 year agreements, define all of the commercial terms for the sale of renewable electricity between the two parties, including when the project will begin commercial operation, schedule for delivery of electricity, penalties for under delivery, payment terms, and termination. The project may be located on-site at the user's location or off-site with the electricity being grid-delivered to the buyer. Physical PPAs by non-utility consumers are generally only allowed in competitive electricity markets and the renewable energy generator and buyer must be located in the same power market to allow for physical delivery of electricity.

How do Physical PPAs work?

In a Physical PPA, an organization signs a long-term contract with a third-party seller who agrees to build, maintain, and operate a renewable energy system either on the customer's property (on-site) or off-site. Regardless of whether the system is on-site or not, the Physical PPA customer receives the physical delivery of (or title to the) electricity through the grid. The customer agrees to purchase the power at a set price over an agreed upon term, and the seller assumes the risks associated with owning and operating the system. Many Physical PPA contracts include an escalator on the price, but these escalation rates are generally below historic price increases associated with the default supplier electricity price. At the end of the contract term, many Physical PPAs with on-site systems offer the customer the opportunity to either sign a new agreement or to purchase the system at fair market value. In this way, some customers can combine immediate savings (through the Physical PPA) with the eventual benefits of system ownership.

Physical PPAs are often an attractive green power procurement option for non-profit organizations that cannot take advantage of federal tax credits to purchase their own renewable energy system. Through Physical PPAs, third-party system owners can pass along tax credit savings to non-profits through lower priced electricity.

Since RECs are treated differently in each Physical PPA, it is important that the customer understand REC ownership in their particular contract. Oftentimes, the RECs are not conveyed to the customer and are instead sold by the project owner into the compliance market. To make claims about using green power from the Physical PPA, the customer must own the associated project RECs. Alternatively, the seller may use REC arbitrage to provide the customer with replacement RECs from another renewable energy project, but the customer's green power use claims need to align with the attributes of the replacement RECs. Learn more about the process of REC Arbitrage. In some Physical PPA structures, the seller retains the RECs for the first few years of the contract (while the sale of RECs may garner higher prices), and then conveys the RECs to the customer for the remainder of the contract term.

Off-site PPA

What is the difference between a Physical PPA and a Financial PPA?

With a Physical PPA, the customer receives the physical delivery of electricity from the seller through the grid, whereas with a financial power purchase agreement (Financial PPA), they do not. This is the key difference between a Physical PPA and an Financial PPA.

Advantages and Challenges of Physical PPAs

Advantages:

- Potential electricity cost savings with no up-frost capital costs

- Long-term electricity cost stability and predictability

- Enables new renewable electricity project to be developed

- Ability to purchase large volume of electricity through a single transaction

- Customer engages directly with a specific project, which can be desirable

- Customer can negotiate specific terms of the contract

- Potential naming rights to renewable electricity project

- Seller is responsible for project's operations and maintenance

- Allows non-profit organizations to take advantage of tax credits through third-parties

Challenges:

- Largely restricted to customers located in competitive electricity markets

- Customers must be located in the same grid region as the generation facility

- Requires long-term contract

- Availability of off-site PPAs limited to customers with large electricity loads and investment grade credit

- Customer must ensure REC ownership in order to make green power claims

- May not have same financial benefit of outright ownership

What are some organizations that are using Physical PPAs?

Many prominent organizations have chosen to use Physical PPAs since the procurement option began to take off in 2013, including Google, Walmart, Stanford University, and the District of Columbia government.

In 2014, Green Power Partners American University and George Washington University jointly signed a 20-year Physical PPA with the Capital Partners Solar Project, supplied by Duke Energy Renewables.1 This agreement enabled the creation of a 52-megawatt solar array in North Carolina, which was the largest photovoltaic project east of the Mississippi River at the time. The project is expected to supply both universities with approximately half of their respective power needs. Learn more about the Capital Partners Solar Project (PDF) (6 pp, 349K) Exit.

Additional Resources:

- American Council On Renewable Energy's Renewable Energy PPA Guidebook for Corporate and Industrial Purchasers: http://s3.amazonaws.com/cdn.orrick.com/files/Renewable-Energy-PPA-Guidebook-for-CI-Purchasers-Final.pdf (PDF) (26 pp, 1.2MB) Exit

- American Wind Energy Association's Corporate Buyers Guide to Wind Energy: http://www.awea.org/corporate-buyers-guide-to-wind-energy Exit

- EPA's Solar Power Purchase Agreement: https://19january2021snapshot.epa.gov/greenpower/solar-power-purchase-agreements

- Rahous Institute's Customer's Guide to Solar Power Purchase Agreements: http://my.solarroadmap.com/userfiles/PPA-Customers-Guide.pdf (PDF) (44 pp, 1.7MB) Exit

- NREL's Power Purchase Agreement Checklist for State and Local Governments: http://www.nrel.gov/docs/fy10osti/46668.pdf (PDF) (12 pp, 880K) Exit