Financial Power Purchase Agreements

What is a Financial Power Purchase Agreement (Financial PPA)?

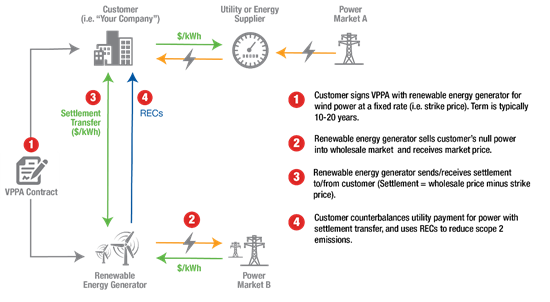

A financial PPA (Financial PPA) is a financial arrangement between a renewable electricity generator (the seller) and a customer, that enables both parties to hedge against electricity market price volatility. Unlike with a physical power purchase agreement (PPPA), there is no physical delivery of power from the seller to the customer. Rather, it is a hedge arrangement that offers buyers cost predictability for their electricity use and promotes growth in the renewable energy sector by offering project developers long-term contracts with predictable revenues — a key element to attracting project financing and investment. Financial PPAs are also sometimes known as virtual or synthetic PPAs, a contract for differences, or a fixed-for-floating swap. Financial PPAs are an innovative and useful procurement option for organizations, particularly those in traditionally regulated electricity markets that generally do not permit PPPAs.

How do Financial PPAs work?

In an Financial PPA, the seller and customer agree to a "strike price" per kilowatt-hour that the seller will receive for its delivery of null electricity into the wholesale market. Thereafter, any monetary difference between the strike price and wholesale market price is exchanged between the two parties, such that the seller in net always receives the strike price for its sales of electricity. The renewable energy certificates (RECs) generated by the renewable electricity generator are usually contractually conveyed to the customer in the Financial PPA. The RECs entitle the customer to exclusive rights to make claims about using the green power produced by the generator and the associated reductions in scope 2 emissions. No electricity is physically conveyed from the generator to the customer, however.

To illustrate how this works, imagine two parties enter into an Financial PPA with a strike price of 10 cents/kWh. The renewable electricity generator owes the customer the difference when the wholesale price is above 10 cents/kWh, and the customer owes the renewable electricity generator the difference when the wholesale price is below 10 cents/kWh. At the close of each settlement period – typically monthly – the customer receives from (or sends) the renewable electricity generator the net difference in price per kilowatt-hour between the strike price and wholesale market price.

Similar to Physical PPAs, Financial PPAs are often an attractive green power procurement option for non-profit organizations that cannot take advantage of federal tax credits to purchase their own renewable energy system. Through Financial PPAs, third parties can pass along tax credit savings to non-profits through lower priced electricity.

Since RECs are treated differently in each Financial PPA, it is important that the customer understand REC ownership in their particular contract. The project's RECs may not be conveyed to the customer and are instead sold by the project owner into the compliance market. To make claims about using green power from the PPA, the customer must own the associated project RECs. Alternatively, the seller may use REC arbitrage to provide the customer with replacement RECs from another renewable energy project, but the customer's green power use claims need to align with the attributes of the replacement RECs. Learn more about the process of REC Arbitrage.

Why would an organization consider an Financial PPA?

An Financial PPA can serve as a hedge against electricity price volatility for the customer when the price of the power being sold by the Financial PPA project into the wholesale electricity market is correlated with the price the customer is paying to purchase the electricity for its own operations. When electricity prices are high in both markets, the customer is being credited at a high rate from the seller and can offset the high cost they are paying for electricity with their credit. Conversely, when electricity prices are low, the customer's electricity costs are also low, but this is counterbalanced by the debit the customer owes to the seller. The net result the purchasing organization is a less volatile cost of electricity.

Organizations likely to use a Financial PPA have:

- a distributed load, such as scattered retail outlets, and the transactional cost of purchasing bundled green power in each grid market is prohibitive; or

- operations in a state(s) with a traditionally regulated electricity market and are not able to do a physical power purchase agreement.

What is the difference between a Physical PPA and a Financial PPA?

With a Physical PPA, the customer receives the physical delivery of electricity from the seller through the grid, whereas with an Financial PPA, they do not. This is the key difference between a Physical PPA and an Financial PPA.

Advantages and Challenges of Financial PPAs

Advantages:

- Potential electricity cost savings with no up-frost capital costs

- Long-term electricity cost stability and predictability

- Enables new renewable electricity project to be developed

- Ability to purchase large volume of electricity through a single transaction

- Customer engages directly with a specific project, which can be desirable

- Customer can negotiate specific terms of the contract

- Potential naming rights to renewable electricity project

- Seller is responsible for project's operations and maintenance

- Allows non-profit organizations to take advantage of tax credits through third-parties

Challenges:

- Financial contract can be complex to navigate

- Requires long-term contract

- Availability limited to customers with large electricity loads and investment grade credit

- Complexity of deal may make conveying story to stakeholders more difficult

- Customer must ensure REC ownership in order to make green power claims

- May not have same financial benefit of outright ownership

What type of organizations can do Financial PPAs?

Creditworthy organizations with large electricity loads can use Financial PPAs to hedge their electricity costs in exchange for providing guaranteed offtake to a renewable energy generator. Organizations engaged in a Financial PPA can be located anywhere in the U.S., including being located in a traditionally regulated electricity market.

What are some organizations that are using Financial PPAs?

Many organizations use Financial PPAs to access green power, including Microsoft, Unilever, Equinix, Mars, Incorporated, and Iron Mountain Information Management.

In 2014, Mars, Incorporated signed an Financial PPA with the 118-turbine Mesquite Creek Wind Farm in Texas, which covers an area as large as Paris, France. This agreement provides enough RECs to cover 100% of Mars' U.S. operations. In 2015, Microsoft signed two different 20-year Financial PPAs, one with Enbridge's Keechi Wind Farm in Texas for about 450 million kWh of electricity, and another with EDF Renewable Energy's Pilot Hill Wind Project in Illinois for about 430 million kWh.1

Additional Resources:

- Financing Wind Projects with Synthetic PPAs: https://www.milbank.com/images/content/1/6/v5/16178/NAWindPower-SyntheticPPAs.pdf Exit

- EPA Webinar slides: https://19january2021snapshot.epa.gov/sites/static/files/2016-09/documents/webinar_kent_20160928.pdf